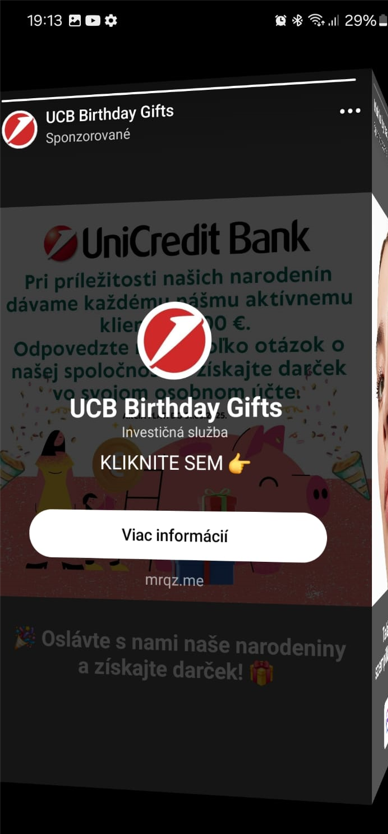

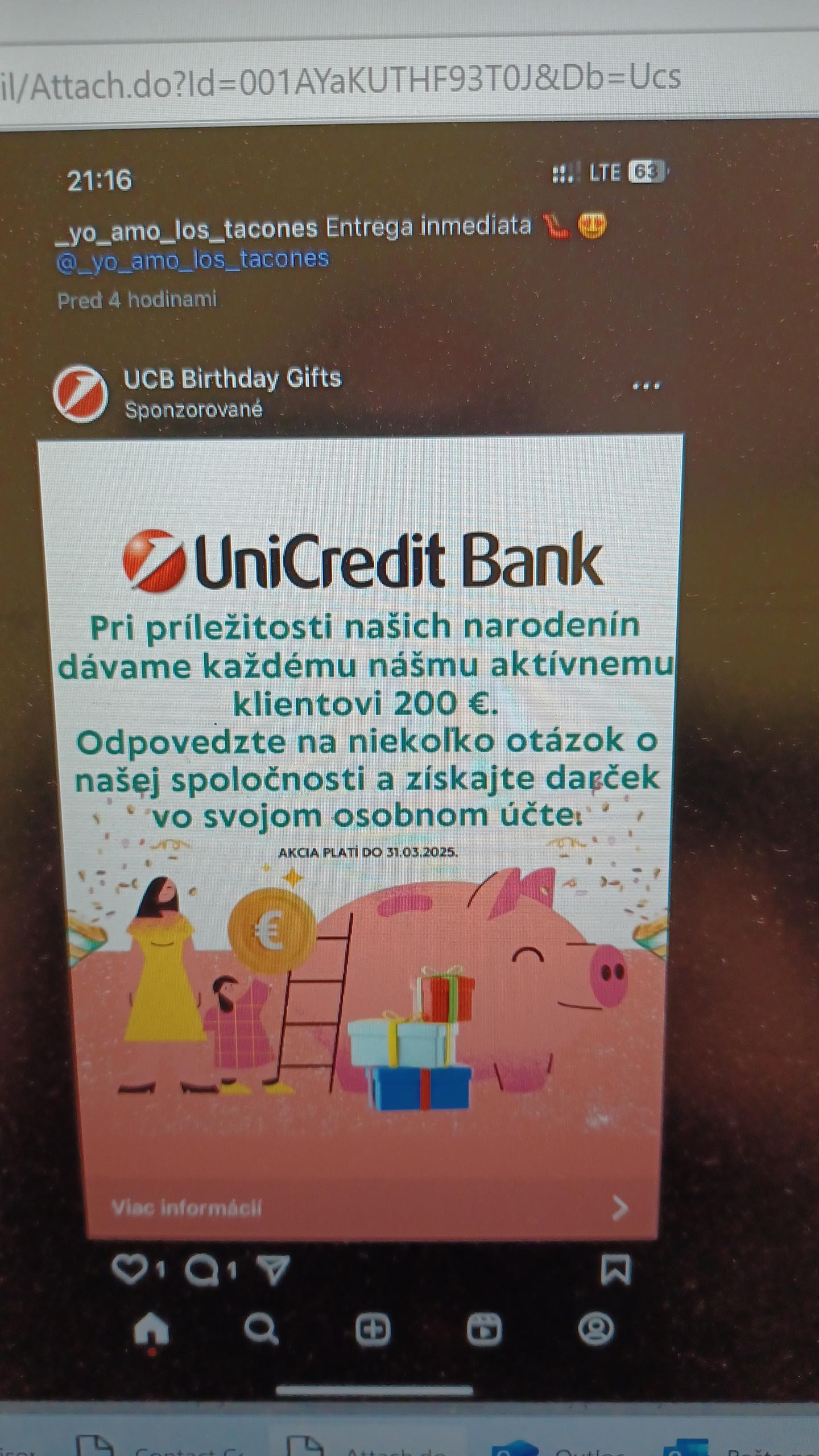

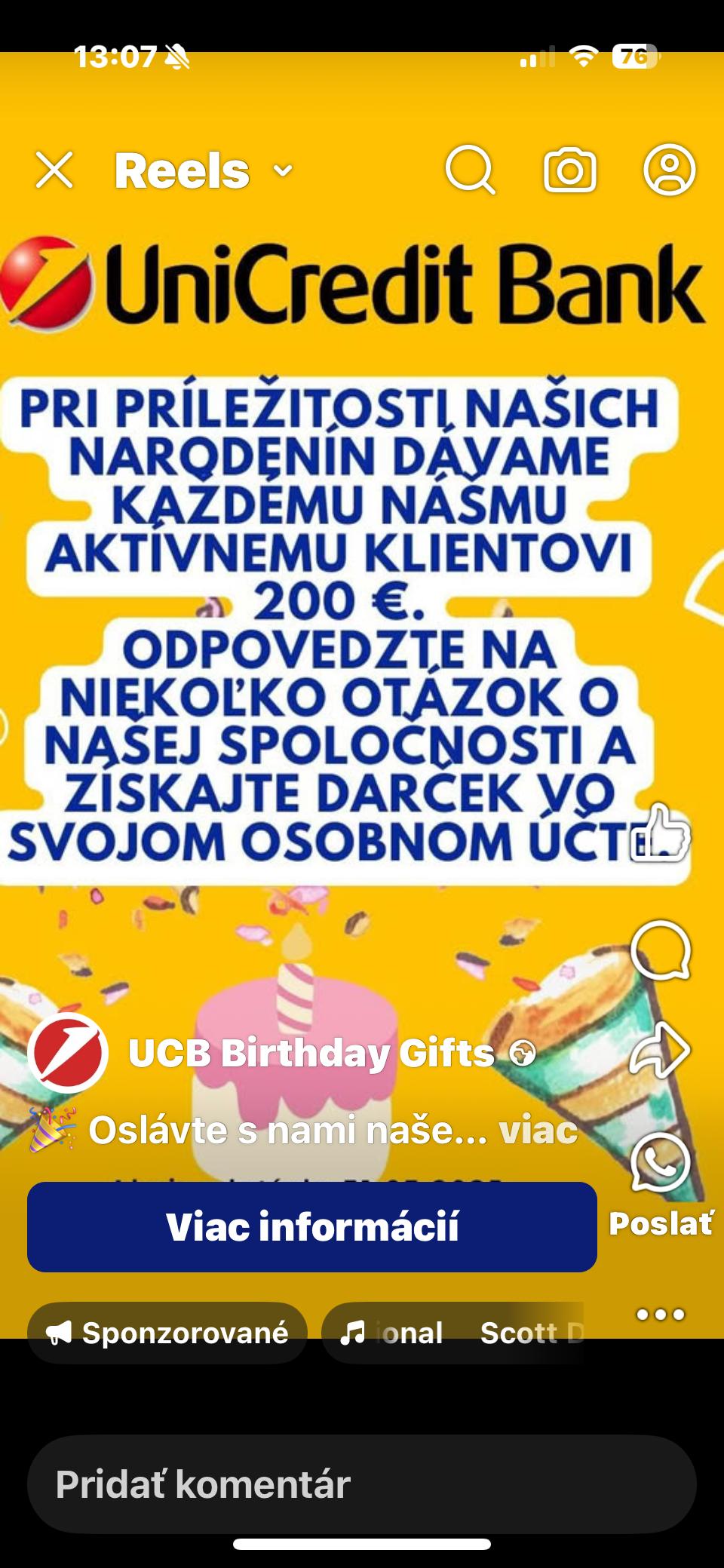

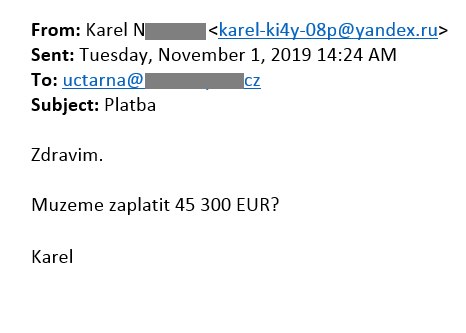

Recently, there has been an increased fraudulent activity in the Slovak Republic. That is why we would like to draw your attention to two very common fraud scenarios:

Selling goods through an advertising platform

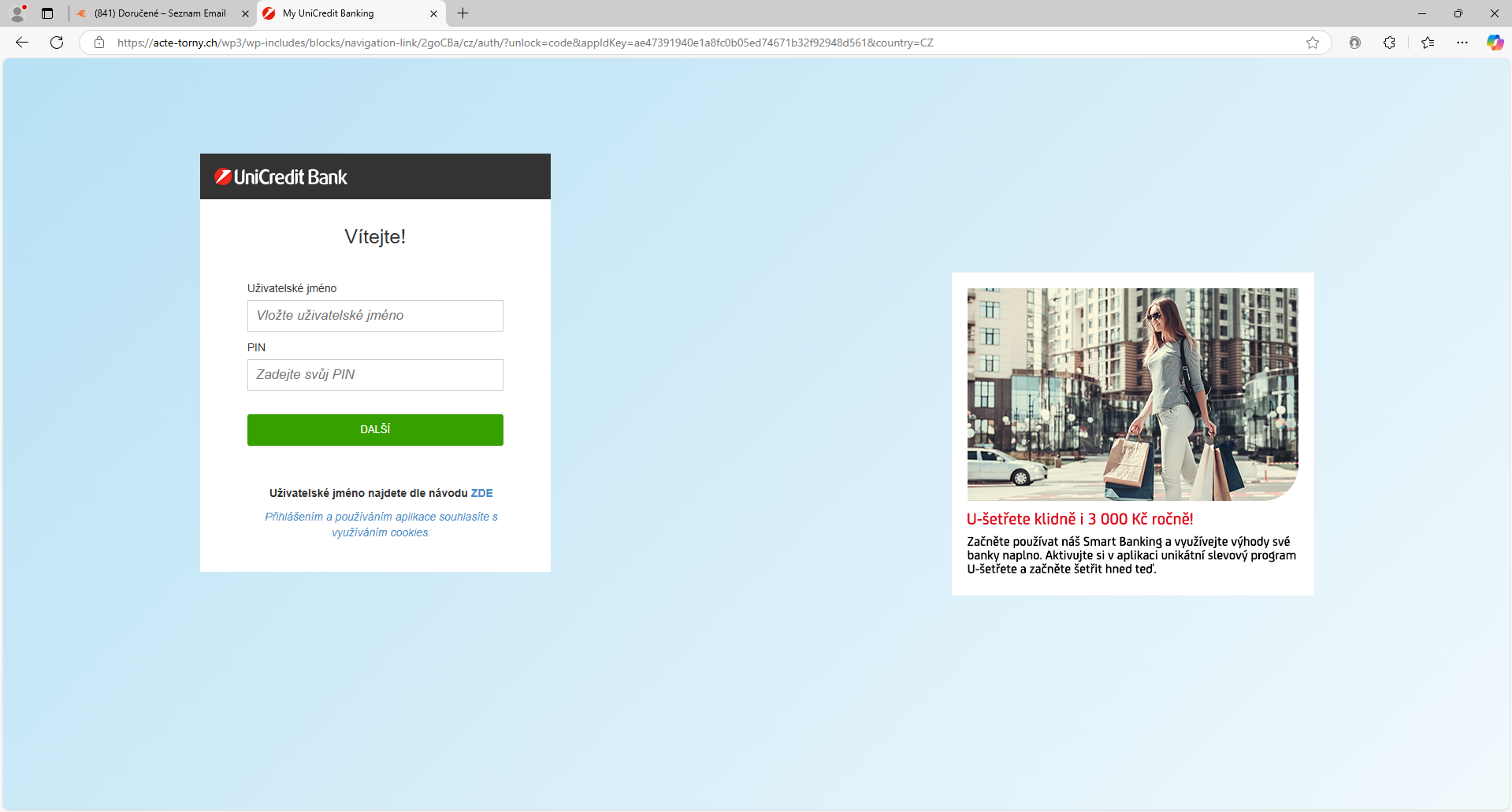

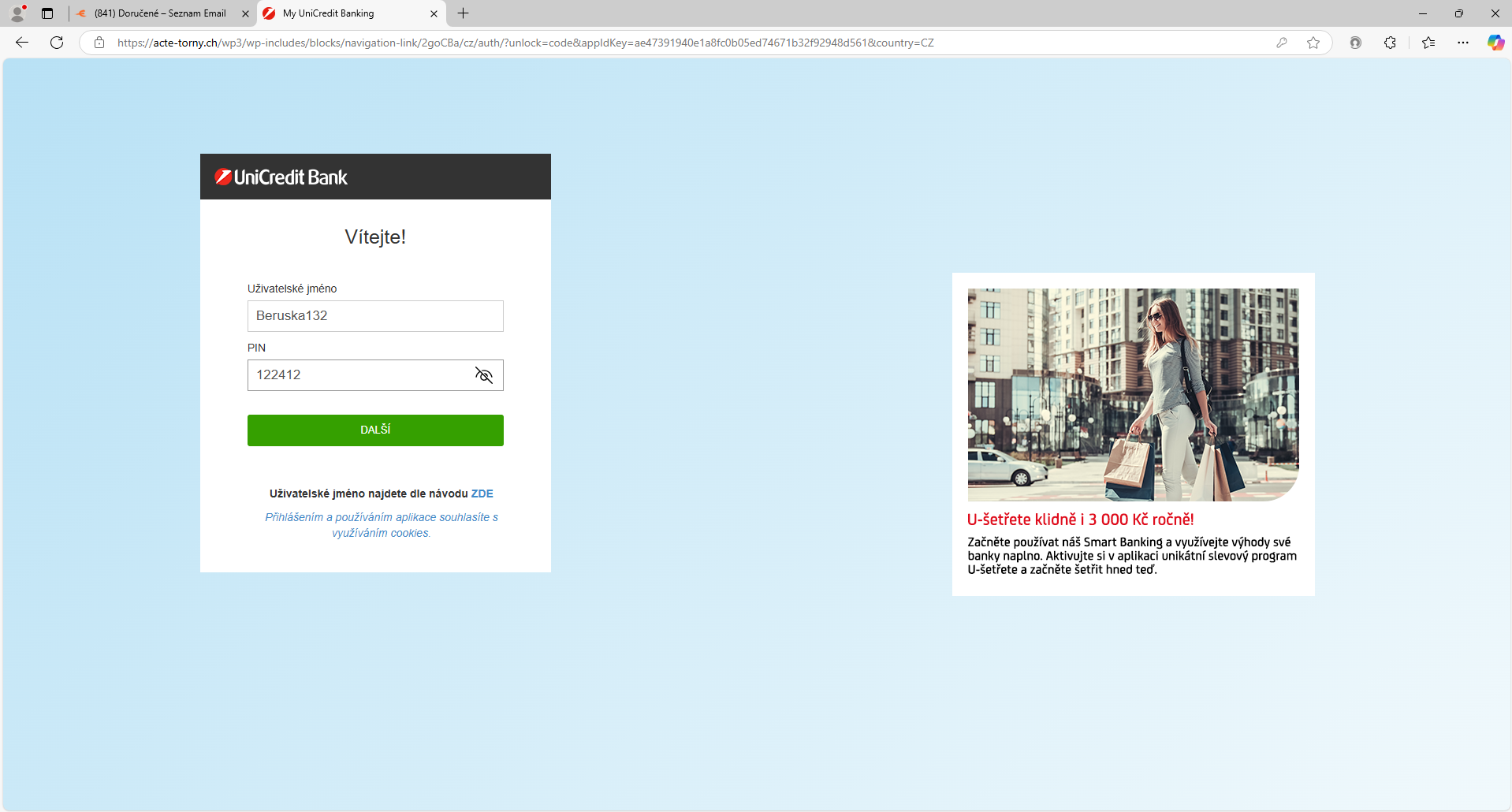

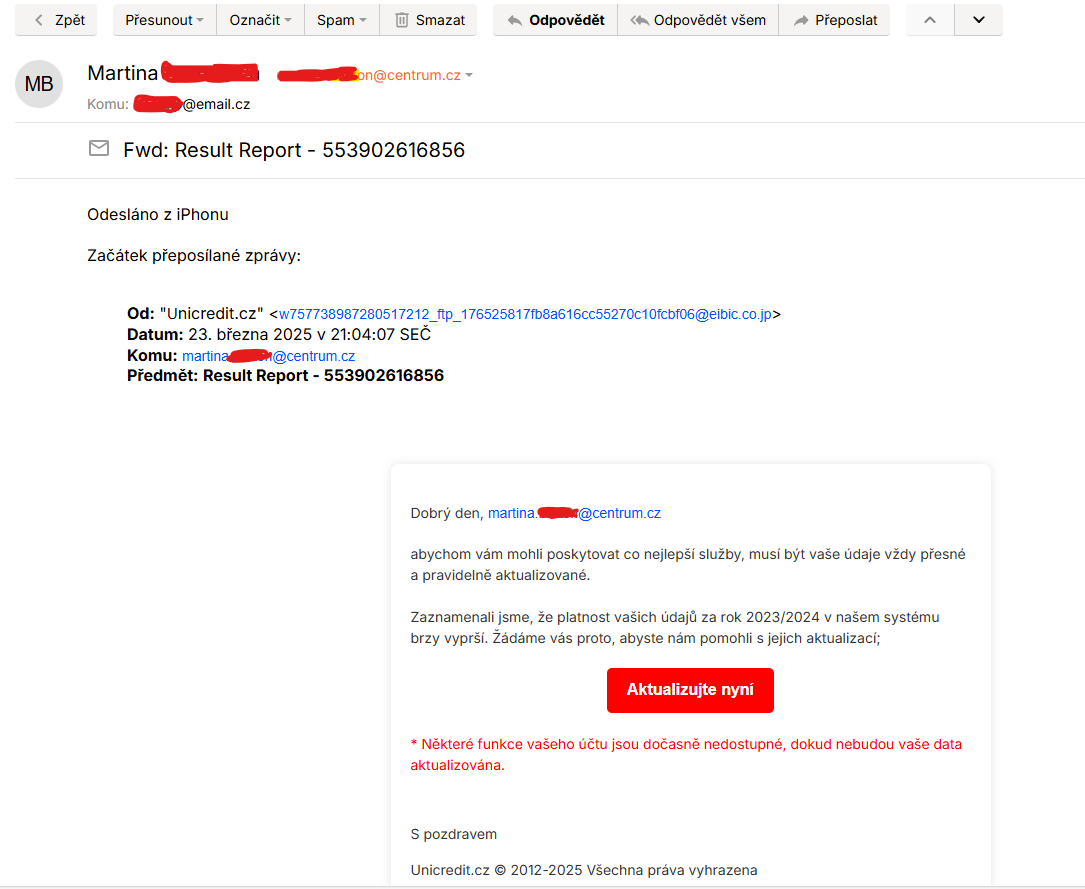

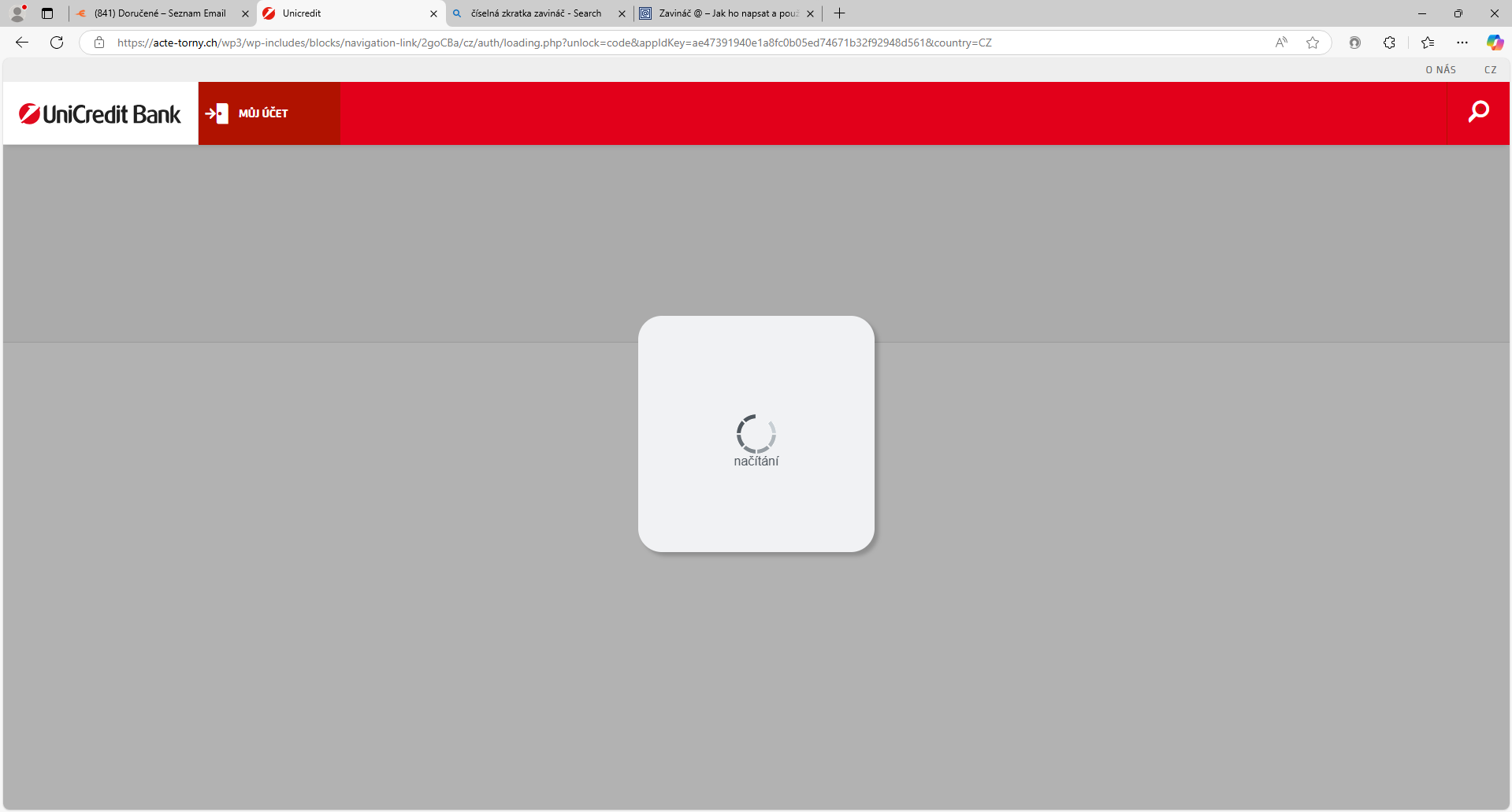

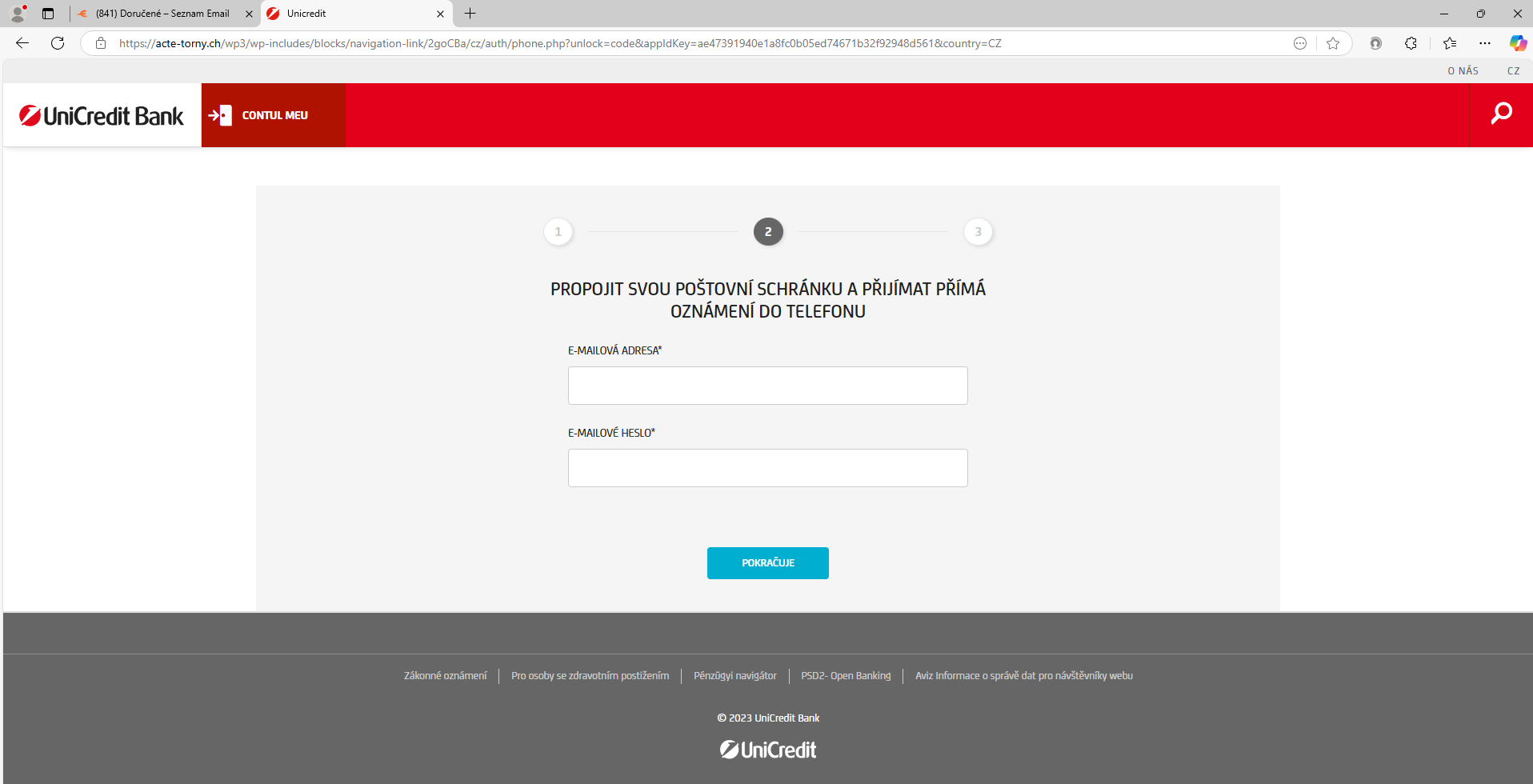

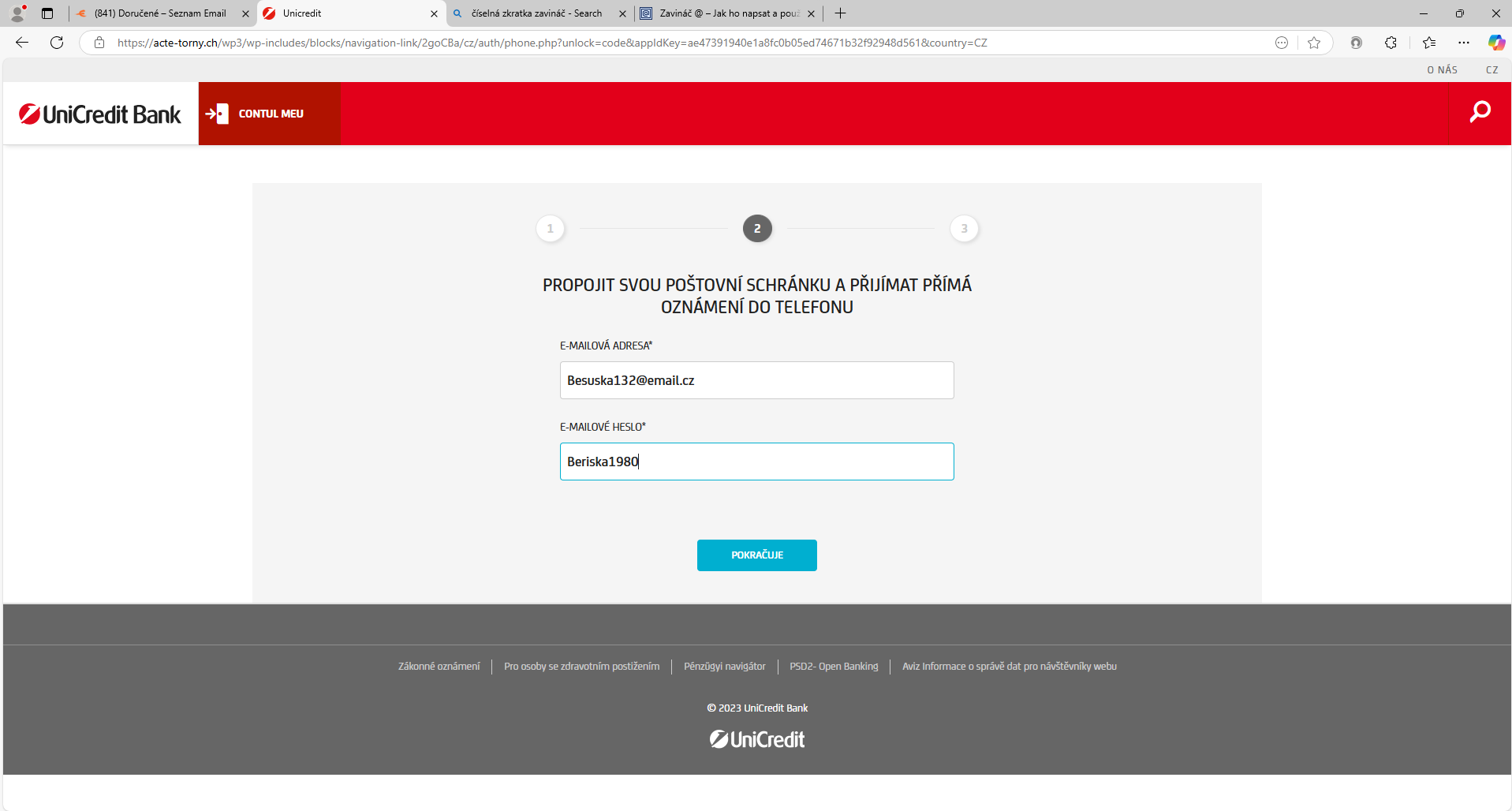

If you are selling goods through an advertising platform and you are contacted by a potential buyer who offers to pay for the goods to your payment card, pay attention. Such a buyer usually wants to know your payment card information (card number, validity, CVV / CVC code, PIN or one-time code) in order to transfer money to your card.

It is not possible to make transactions “to a payment card”; such scenarios are always fraudulent and if you provide your payment card details, your card will be misused by the fraudster.

Always pay attention when using advertising platforms to sell goods. Do not respond to offers to send money to your card and never enter the card details in a form sent to you by the buyer.

Fake Microsoft support service

A fraudster pretending to be a Microsoft employee calls you (usually from an international number and the call is in English) and informs you of a problem with your computer. He or she invites you to install an app and wants you to allow remote access to your computer or pay a technical support fee. Pay careful attention! Microsoft never asks clients to allow remote access to their computer.

Never share your payment card information, install unknown apps, or allow remote access to your computer, Internet banking, or your data based on similar calls.

Read more information on frequent fraud and security advice HERE.

If you are not sure about the authenticity of incoming e-mails, messages or calls, please contact the UniCredit Bank Infoline at +421 2 6920 2090.